The year has started on a high note for the mobile marketing industry, fueled by numerous positive insights from 2021. For instance, the global revenue from mobile gaming exceeded USD 90 billion, according to App Annie's latest data analysis.

Last year saw numerous mergers and acquisitions, which helped consolidate many studios, similar to trends in 2020. A DDA Agency report found that financial investments in Q3 2021 were 2.6 times higher than in 2020, with three times more M&A activities than the previous year. Game companies invested approximately $71 billion in 2021 across 844 M&A operations, according to AppsFlyer.

In Latin America, consumer spending on mobile games in 2021 approached USD 3.5 billion. The top three countries in mobile game revenue were Brazil, Mexico, and Argentina, with Mexico outspending Brazil in terms of consumer spending. The region's lower penetration of console and PC gaming, due to higher hardware costs, makes mobile gaming more accessible, especially with the widespread availability of Android devices from Chinese and Korean brands.

This accessibility has made mobile games more popular in LATAM than any other gaming segment. With better devices entering the market and 5G technology becoming more available for both Android and iOS users across the continent, the online and collaborative mobile games segment is poised for significant growth.

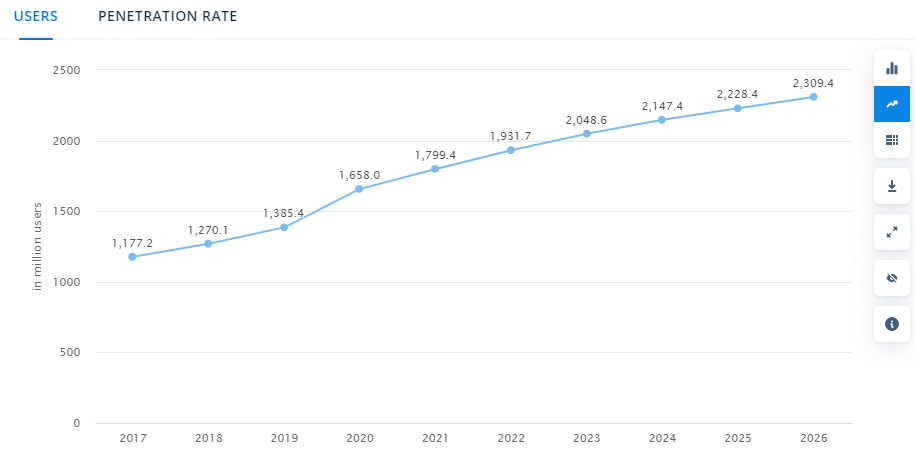

Statista has shared some insights for the Mobile Games market for this year, such as the projected number of users reaching 1,931.7m. Also, the average revenue per user should get close to U$ 64,66 and the total revenue for the Mobile Games segment is expected to reach U$124,905m and to keep growing steadily as it has been for the past few years.

The mobile gaming sector has significant financial resources and experienced exponential growth in 2021. With Apple's iOS 14 privacy policy, a rising number of players, and numerous mergers and acquisitions among gaming studios, we can make a few key observations:

Larger studios, with more financial resources to invest in-game updates, user experience, and advertising, will benefit from the user data acquired through mergers and acquisitions. This influx of data will enhance their analytics capabilities and consumer insights, enabling them to refine their user acquisition and retargeting strategies.

Smaller or independent studios have always faced challenges compared to their larger counterparts, not only in mobile gaming but also in PC and console gaming. In the "post-iOS 14" landscape, these studios must adapt swiftly to remain competitive for iOS users. While Apple's privacy policy restricts the richness and quantity of user data, it doesn't eliminate it. Business intelligence professionals in smaller studios will need to interpret and leverage data more effectively to gain valuable industry insights and develop robust user acquisition strategies.

The idea that "gaming is for everyone" is not new, but it is advancing faster than ever. With people spending more time on their phones since the pandemic, the rise of new social technologies like the Metaverse, the growing popularity and accessibility of virtual reality glasses, and Gen Z's constant creation and engagement with content, it's only natural that gaming is becoming a daily activity for many.

This category of mobile ads is poised to become even more popular across various sectors, given the expected increase in players and high penetration rates. Brands are likely to invest more in campaigns that incorporate in-game ads. Ad designers should prioritize the user experience, creating in-game ads that seamlessly integrate into the gameplay without disrupting it. Ads that are correctly targeted and customized based on player insights will likely see higher engagement, as they align with the interests and preferences of the players.

Verticals that focus on relevant, customized, modern, and user-friendly ads will find success with in-game ads this year, as the mobile gaming industry and its communities continue to grow steadily. With the advent of the Metaverse and the increasing adoption of virtual reality, we may indeed be entering the age of virtual augmented reality in gaming and social media.

If you still don’t have an ad strategy that includes mobile games, don’t worry, Rocket Lab can help you with that! Get in touch with us so we can talk more about your user acquisition and retargeting strategy for 2022!