Growing an app is no longer about getting as many installs as possible. Most teams have already learned that lesson the hard way. Today, the real question is how to acquire high-value users in LATAM and build growth that lasts.

Sustainable growth in the region depends on understanding user quality, not just acquisition volume. It means identifying users who retain, transact, and come back over time, and knowing how different channels contribute to that value across the lifecycle.

This is where many strategies fall short. Teams invest heavily in acquisition without a clear plan to connect segmentation, engagement, and retention. Others rely on benchmarks or playbooks that don’t reflect how users behave in Latin America. The result is short-lived growth that looks good on paper but fails to scale profitably.

At Rocket Lab, we approach this challenge through our App Growth Hub model, combining multiple growth solutions, data transparency, and local intelligence to help apps grow smarter, not just bigger.

For a long time, mobile app growth in LATAM was measured with one simple metric: installs. More installs meant growth. Lower CPI meant success.

Today, that logic no longer holds.

Across LATAM markets, acquisition costs have been steadily rising. For instance, CPI has risen an average 10% in markets like Mexico, Colombia, Chile, and Uruguay as apps mature and ad investments scale up fivefold. Channels that once delivered cheap scale are now crowded, competitive, and less predictable. At the same time, users download more apps but keep fewer of them. This has changed the equation completely.

This is where many apps hit a wall. They keep investing in volume, but revenue, retention, and engagement don’t grow at the same pace. The result is a large user base with low activity, low LTV, and high churn. In other words, growth that looks good on paper but doesn’t hold up in the business.

This is why conversations are shifting from “how do we get more users?” to “how do we acquire high-value users in LATAM?”

High-value users are not defined by where they come from, but by how they behave. They return to the app. They complete key actions. They convert, subscribe, or transact. And most importantly, they generate value over time.

Focusing on app user quality in LATAM changes how growth decisions are made. Instead of optimizing only for CPI, teams start looking at retention curves, cohort performance, and downstream events. Instead of scaling one channel aggressively, they diversify and connect acquisition with engagement strategies.

This makes value-based growth even more critical in LATAM. Income levels, payment habits, device usage, and app maturity vary by country. Treating all users as equal leads to inefficient spend and misleading conclusions.

In LATAM today, growth is no longer about reaching everyone. It’s about reaching the right users and giving them reasons to stay, so apps can build a base of high-value users and build healthier growth.

Finding high-value users in LATAM is about learning how value actually shows up over time. This is where many teams struggle. They look at installs, early events, or one strong campaign, but miss the deeper signals that define long-term growth.

When we talk about app LTV optimization in LATAM, we are really talking about understanding behavior, not volume.

A high-value user in the region usually shares a combination of these traits:

Retention behavior

They do not disappear after the first session. They come back. Sometimes quietly, sometimes often, but consistently. Retention over weeks matters more than activity in the first 24 hours.

Transaction or usage patterns

Value is not always about big purchases. In many apps, frequent small actions are a stronger signal of future LTV than one early conversion. Looking at how often users transact, reorder, subscribe, or complete key actions gives a much clearer picture.

Engagement over time

High-value users build habits. They interact with more features, respond to messages, and stay active even when promotions slow down. This is where true user quality appears.

The challenge is that these signals are rarely visible if segmentation is too generic. Many teams rely on broad audiences or global assumptions that flatten real differences. This is why user segmentation in LATAM must be built locally and intentionally.

Strong segmentation usually starts with:

Cohorts based on retention windows, not just installs

Grouping users by frequency and depth of engagement

Identifying patterns that repeat across weeks, not days

Separating early curiosity from long-term behavior

The biggest pain we see is not lack of data, but weak governance. When data is not properly organized, classified, and connected across teams and channels, high-value users stay buried inside large audiences, making it harder to see where real growth comes from.

Once you know what a high-value user looks like, the real challenge is finding more of them and keeping them engaged over time. In LATAM, this only works when acquisition and retention are planned together, not treated as separate efforts.

High-value growth depends on reaching users with the right signals from the start. Instead of optimizing only for reach or installs, teams need to prioritize quality indicators tied to real behavior inside the mobile ecosystem. This means understanding how users interact with apps, how often they return, and which actions indicate long-term value, before and after the install.

Acquisition plays a key role in setting that foundation. When targeting is built around meaningful signals, apps can avoid wasting budget on users who churn quickly and focus on audiences more likely to engage, convert, and stay active. Quality is shaped early, not fixed later.

Retention is where that value is confirmed and expanded. Lifecycle communication, reactivation strategies, and thoughtful frequency control help turn initial interest into habits. A user who installs but disappears after a few days adds no value, regardless of how efficient the acquisition looked.

The strongest strategies treat retention as a continuation of acquisition. Each interaction after install feeds back into how future users are acquired. What converts, what retains, and what drives repeat behavior should influence how budgets are allocated and which audiences are prioritized next.

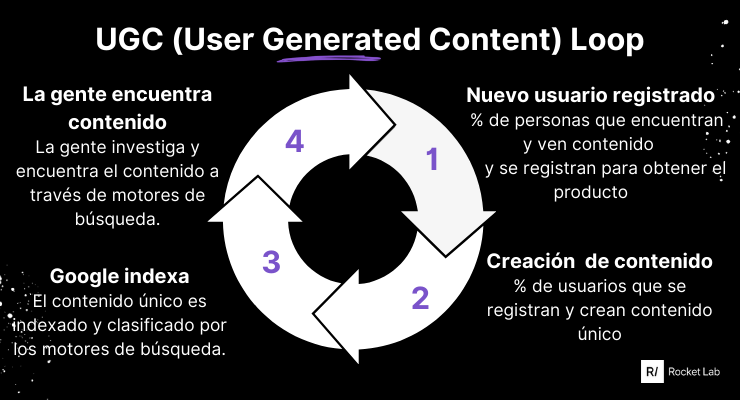

When acquisition and retention work as one system, growth becomes more stable. Instead of chasing short-term volume, apps build momentum around users who actually contribute to long-term value. That is how high-value user strategies in LATAM move from theory to real, sustainable results.

For many apps in LATAM, growth still starts and ends with acquisition. But, as we’ve seen throughout this piece, the apps that grow sustainably are the ones that shift the conversation toward retention and lifetime value.

Retaining users is simply more efficient than constantly replacing them. When users stay active, convert more than once, or come back on their own, the effective cost of acquisition drops. Every retained user increases app LTV without increasing media spend. That is why app LTV optimization in LATAM is one of the strongest levers for profitable growth.

The challenge is that retention is often measured in isolation. Acquisition teams look at installs and CPIs. CRM or engagement teams look at opens, sessions, or reactivations. When these views are disconnected, it becomes hard to understand which users are actually valuable and where budgets should go.

At Rocket Lab, we focus on closing that gap. Retention data should inform acquisition decisions, not live in a separate report. By analyzing cohorts over time, we help teams see which acquisition sources, segments, and moments generate users with higher lifetime value. This allows brands to invest more confidently in strategies that attract high-value users from the start.

Unified measurement across channels is key here. When acquisition, engagement, and reactivation are measured together, patterns become clear. You can see how users behave after install, how long value compounds, and which actions truly make a difference in your growth strategy.

At Rocket Lab, performance is not about chasing short-term wins. It is about helping apps understand who their best users are and building growth around them over time. That mindset defines how we operate as an App Growth Hub in LATAM.

Everything starts with segmentation, transparency, and data governance. We make sure teams have clear access to data and reporting, so they can understand where users come from, how they behave, and how much value they generate across their lifecycle. When data is structured and visible, decisions become more precise.

From there, we activate the right mix of solutions based on each app’s growth goals. There is no fixed formula. Some apps need to capture high-intent demand through Apple Ads. Others need stronger discovery on Android with First-impact Ads and OEM environments. Reach Beyond and Programmatic Ads help scale acquisition and engagement, while Eyes-on adds incremental reach and brand exposure through CTV. What matters is not the channel, but how each solution contributes to building a qualified, long-term user base.

This approach is supported by real-time optimization and continuous learning. Our systems adjust audiences, bids, creatives, and channels as campaigns run, based on what is actually driving retention and value, not just installs. Insights move across the funnel instead of staying trapped in isolated reports.

A clear example of this mindset is our work with iFood in Brazil. As their strategy evolved, they shifted from relying on a single channel to activating a multi-solution mix that included Reach Beyond, Programmatic Ads, First-impact Ads, and Apple Ads. This diversification, combined with consultative support and ongoing optimization, helped build a more consistent and qualified user base. The result was not just more reach, but stronger performance stability across platforms.

What makes Rocket Lab different is the hub structure itself. Strategy, media, data, and optimization live together. That reduces friction, speeds up decisions, and keeps every action aligned around one goal: growing high-value users in LATAM.

High-value growth in LATAM does not come from chasing volume or relying on a single channel. It comes from understanding who your best users are, how they engage, and what truly drives long-term value. Segmentation, retention, and real intelligence are what turn installs into sustainable growth.

That is why app LTV optimization in the region requires a connected approach. As an app growth hub in LATAM, Rocket Lab brings strategy, data, and execution together to help apps grow high-value users over time.

If you want to build a value-driven growth strategy for LATAM, our team is ready to talk.