In this article, we explore user acquisition strategies in the context of fintech in Brazil, a constantly growing and evolving market.

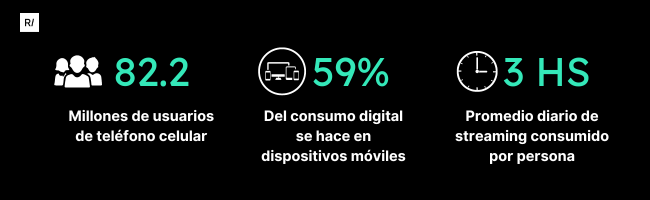

Brazil has a booming mobile app market. Over 78% of consumers in Brazil accessed the internet through their mobile devices in 2022. Additionally, Brazilians spend a considerable average of 5.4 hours per day on apps.

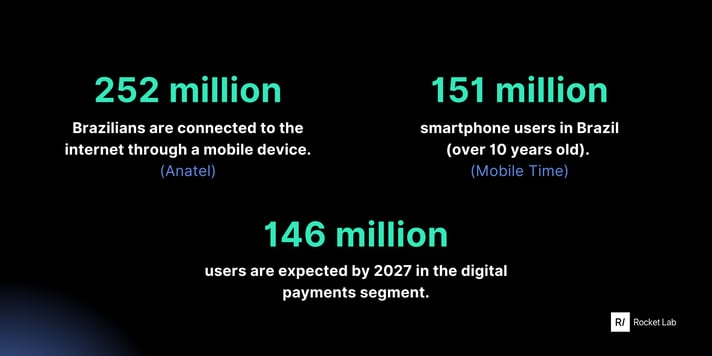

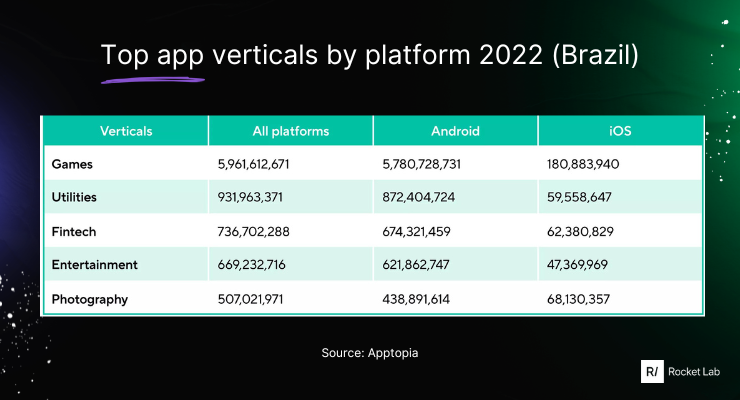

According to a report by Rocket Lab on 2022 about the mobile market, the following data was recorded:

252 million Brazilians connected to the internet through a mobile device;

151 million smartphone users in Brazil (aged 10 and above);

By 2027, in the digital payments segment, the number of users is expected to reach 146 million.

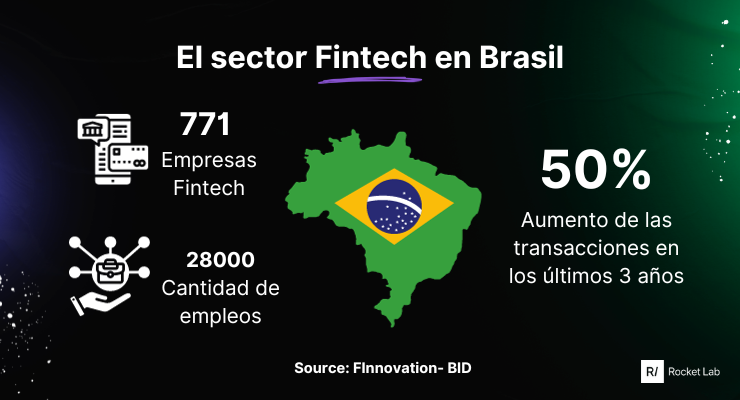

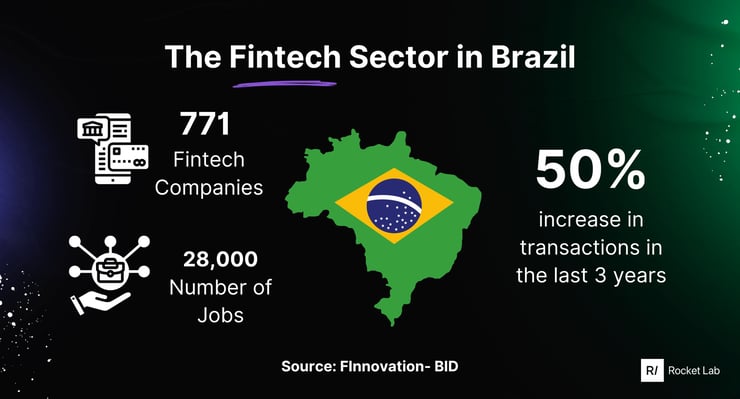

Another relevant statistic is that the Inter-American Development Bank (IDB) reported that the fintech sector in Latin America experienced a 112% growth between 2018 and 2021.

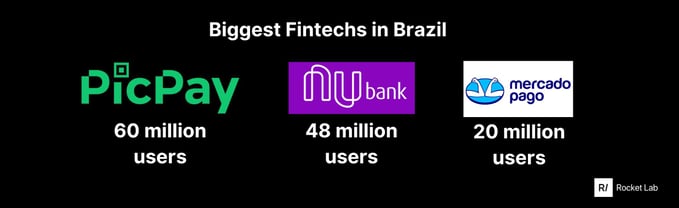

There is no single answer as different perspectives define it. The Brazilian Central Bank considers Nubank as the fintech with the highest number of customers (49 million), followed by PicPay and Mercado Pago.

According to figures reported by the companies, Picpay would be the largest fintech in Brazil with 60 million users, followed by Nubank (48 million) and Mercado Pago (20 million). In terms of active users, Nubank tops the ranking with over 38 million, followed by AME Digital (16 million) and Pan (15 million).

The largest digital bank on the continent was born in Brazil, it's Nubank, which has a valuation of US$48 billion and has already debuted on the New York Stock Exchange. The institution reported 75 million customers in Brazil in the first quarter, 4.4 million more than in the previous three-month period. Picpay, another digital wallet in the country, also reported its first profits this year.

The smaller Banco Inter, for example, added 1.4 million new customers in the last quarter.

Pismo, a company founded in 2016, is the latest success case of a Brazilian fintech firm, the sector that attracts the most venture capital in the country and in Latin America. It was acquired by Visa last June, in one of the biggest operations in the history of the local technology market.

The fintech market in Brazil has grown significantly in recent years. According to data from the Central Bank of Brazil, the number of registered fintechs in the country has steadily increased, covering a wide range of financial services.

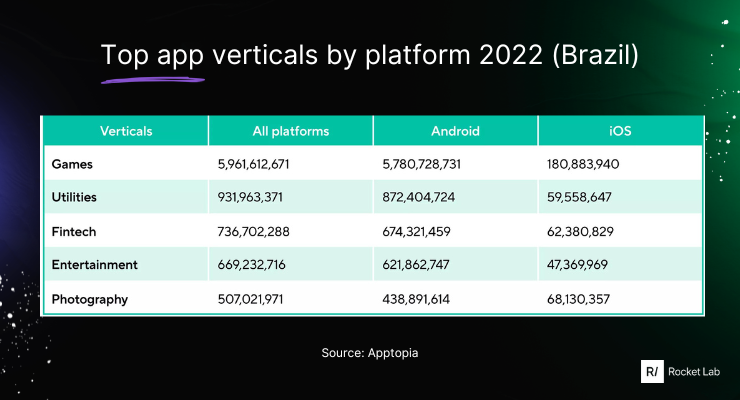

This is happening in a context where Brazil increased its spending on applications by around 20% compared to 2021 in 2022. This increase positioned Brazil as the 11th app market in the world and surpassed Saudi Arabia and Italy in the global ranking.

In the largest country in South America, in Q1 2023, global investments in fintechs reached $28.8 billion through 1,399 deals.

In the digital payments segment, it is expected that the number of users will reach 146 million by 2027.

Regarding the operational categories of Brazilian fintechs, there are several possible fields of activity. According to a survey by Distrito, 17.8% of fintechs in Brazil operate in the Credit category, followed by 15% of Backoffice Fintechs (software and services to manage different areas of companies' financial lives).

Payment Media Fintechs represent 13.2% of the market, in addition to those operating in the Technology category - providers of basic technology for other companies and financial institutions - which account for another 12.6%.

In 2018, the Central Bank of Brazil gave the green light for fintechs to provide credit without requiring bank intermediation. It has also implemented regulations to govern cybersecurity and crowdfunding activities.

According to ABFintechs, it is expected that fintechs in Brazil can generate revenues of up to US$24 billion in the next ten years.

In essence, it is about convincing people to use the services of a fintech instead of resorting to traditional financial methods.

Today, the Finance vertical is responsible for almost 50% of user acquisition investments in Brazil. Fintechs invested almost three times more than any other business vertical in the country, with around US$911 million invested in user acquisition.

IPC costs in finance are three times higher than the market average in Brazil, making the financial app market the most competitive vertical in Brazil.

The UA strategy in fintechs involves several key elements. Let's see:

It is one of the most effective ways to attract new users. This includes online advertising, content marketing, and the use of social networks. Brazilian fintechs have largely adopted these strategies to reach a wider audience.

When fintechs offer incentives to users to refer friends and family. This not only increases the user base but also fosters trust in the platform.

This can increase brand exposure and attract new users interested in the combination of services.

The Brazilian financial industry tends to increasingly adopt the fintech movement, a concept that, according to Distrito, refers to the movement in which companies not part of the financial sector begin to offer products and services of this nature. That is, companies maintain their core business but include other financial market-related services or products in their portfolio.

Through this movement, companies centralize the execution of services in one place, reducing expenses, retaining old customers, and attracting new ones.

Innovation through technology is a natural and important process for any sector, but it depends on each company's strategy to understand the best way to incorporate it to boost its business. Many companies that have gone through the fintechization process, for example, took the opportunity to make their services easier, more personalized, and more accessible to a greater number of customers.

.png)