In Latin America, over 150 series or movies are produced each year for streaming platforms, making the region a great place to scale advertising campaigns.

Mexico, as one of the largest countries in the region and a reference in the streaming industry, has significantly contributed to the growth of the market. Why is this the case? The combination of a young population, a growing internet penetration (an average of 75% in LATAM), and the adoption of smart devices has created an ideal scenario for streaming platforms.

Companies such as Netflix, HBO Max, Amazon Prime Video, Disney+ and others, have gained a solid presence in the Mexican market, offering a wide range of entertainment options for consumers.

The overwhelming popularity of streaming and the acceptance of ad-based models by viewers indicate future growth in this segment and more opportunities for both creators and advertisers. Let's see some data to understand it better.

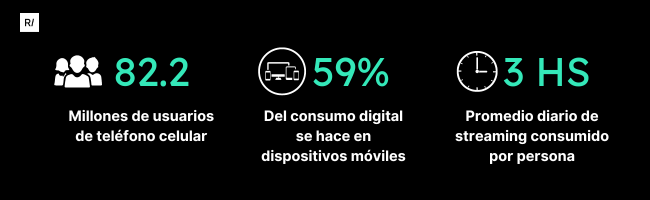

According to the latest National Survey on Availability and Use of Information Technologies in Homes (ENDUTIH), there are 88.2 million mobile phone users in Mexico.

In Mexico, 59% of digital consumption occurs through mobile devices. 15% is done via desktop, and 26% is multi-platform.

On average, each person consumes 3 hours of content daily through streaming platforms compared to 2.5 hours of traditional television, according to the National Survey on Audiovisual Content Consumption (ENCCA) 2022.

However, it is important to consider other evidence of this growth.

Original series, movies, and documentaries are being tailored to specific audiences. Streaming services acknowledge the importance of providing content that resonates with local culture and preferences, and producers are collaborating with streaming platforms. An example of this is VIX, a digital content streaming app that has gained popularity by offering major sports events, such as football matches, for free, contributing to its growth and success in the Mexican digital entertainment market.

International players like Netflix, Amazon Prime Video, HBO Max, and Disney+ are competing with local platforms such as Claro Video, Blim, and Azteca Uno from TV Azteca. It's a true competition.

It presents itself as the new expanding niche. Sports events are gaining strength in Mexico, including football matches, boxing fights, and Formula 1 races.

Mexicans are consuming streaming content on multiple screens more than ever. Streaming platforms are adapting by optimizing their interfaces and user experiences for various devices and offering synchronized viewing across multiple platforms.

This point becomes significant in the context of rising costs for users. Some telecommunications companies in Mexico are already offering streaming services as part of their internet and mobile phone packages.

In the streaming world, different subscription models have emerged to cater to user preferences and needs. Let's explore some of them.

This is the most common model, where users pay a monthly fee to access all the content available on the platform, for example, Netflix or Spotify.

The commitment is for a complete year. Users often receive discounts for long-term commitment, which can boost user retention and financial stability for the app.

The app offers basic content for free and premium options through a subscription. This attracts users with free options and then incentivizes them to upgrade for exclusive features, ad-free experience, or higher quality. Spotify uses this model.

Users get full access during a free trial period, then are prompted to subscribe to continue. This allows users to experience the service before making a financial commitment.

For live content or special events, users pay for a specific event rather than a continuous subscription. This can work well for exclusive sports or niche content.

Users pay only for the content they access, rather than a full subscription. This is useful for platforms with a wide range of content and viewing preferences. This model is common on Video on Demand (VOD) services like Amazon Prime Video.

Some streaming apps offer free content but include interlaced advertisements. YouTube is a popular example of this category.

While the initial acquisition is crucial to build a user base, retention is essential for sustainable growth and long-term profitability. The strategy must be creative to keep users engaged and satisfied in an ever-evolving market.

In a streaming app, the subscription model allows the evaluation of several marketing metrics, such as:

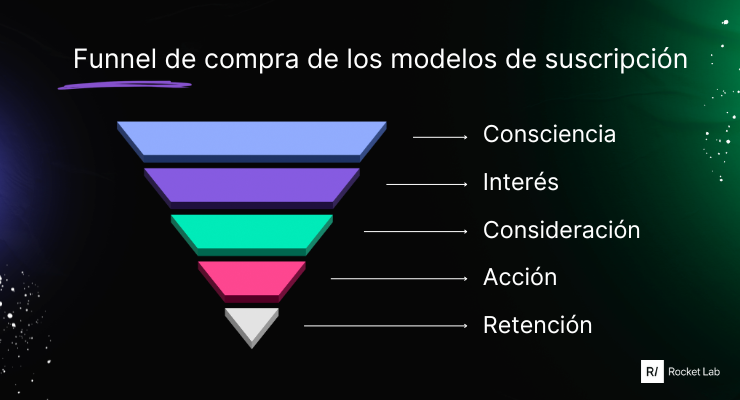

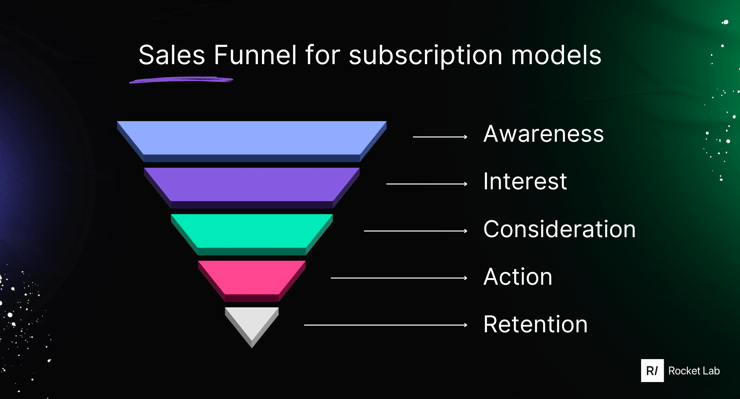

The Sales Funnel in a subscription model for a streaming App consists of 6 stages.

Initially, the stage is awareness, in which potential users become aware of the app's existence through advertising, recommendations, social media, etc.

Next, users show interest in the service and visit the app's page, explore free content, or read reviews and ratings.

In a third stage, the consideration begins, where subscription becomes a possibility for users after experiencing free content or free trials.

Finally, the action comes when users convert into paying subscribers. However, it doesn't end there; the current challenge is retention. In this stage of the funnel, the app works to keep subscribers satisfied by offering quality content, personalization, and customer support.

Platforms have understood the importance of catering to the tastes and preferences of a diverse population by offering a wide range of options: from international productions to national movies and series. This has allowed them to reach audiences of all ages and cultural backgrounds.

From classic “telenovelas” to contemporary productions, local content has proven to be a key factor in streaming adoption in Mexico. Platforms have invested in the creation and distribution of Mexican content, attracting audiences looking to connect with familiar stories and cultural contexts.

Furthermore, the option to choose between Spanish version or the original audio has allowed viewers to personalize their viewing experience.

The Mexican streaming market is saturated with options, from global to local services. Platforms must find unique ways to differentiate themselves and provide additional value to keep users engaged.

A pleasant user experience is essential for retention. Technical issues, complicated interfaces, or confusing navigation can ultimately lead to subscription cancellations.

64% of users consider the cost of all the services they desire to be too burdensome, and 31% are considering reducing their spending on subscriptions in the coming months. This demands careful cost management and a solid retention strategy to ensure prices are affordable for the Mexican audience.

In the context of the Pay-TV Forum 2023, Ivan Vitório, Manager of Insights at Parrot Analytics, divided the evolution of the streaming market into access, production, and retention. It is in this wave that we currently find ourselves. Regarding the retention vs. acquisition axis, Vitório emphasized the need to understand which title is responsible for retaining subscribers and what retention power each one holds.

It is clear then that content has a direct impact on subscriber retention. Platforms must balance the need for exclusive and fresh content with classic and popular options to satisfy the changing tastes of users. Mexico, with its diverse range of available content, shows one of the reasons behind the success of streaming.The answer to where marketing efforts should be focused, whether on user acquisition or retention, is not as simple as choosing one over the other. Marketing efforts in a subscription model need to be balanced to achieve sustainable growth.

In a market like Mexico, acquiring new users is essential to increasing the customer base. Therefore, running advertising campaigns can attract the attention of new users and generate a steady stream of revenue. Additionally, providing an exceptional user experience with quality content and a user-friendly interface is crucial to retaining existing subscribers and achieving user retention.

However, the true profitability and long-term success of a streaming platform largely depend on user retention. Once viewers become subscribers, it is crucial to maintain their engagement and satisfaction to prevent subscription cancellations. This is where marketing efforts must evolve to maintain a loyal and engaged user base.

Latin American audiences have a positive view of the value of streaming, with 96% of ad-supported streaming consumers considering it good value for entertainment.

The diversity of options, the focus on local content, and competitive strategies have contributed to the success of these platforms in Mexico. While technological challenges persist, the future of streaming in the country looks promising as platforms continue to innovate and adapt to provide an exceptional viewing experience.